UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14a INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

MARIMED INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

MARIMED INC.

10 Oceana Way

Norwood, MA 02062

Notice of Annual Meeting of Stockholders

To be held on September 26, 2019

August 26, 2019

To our Stockholders:

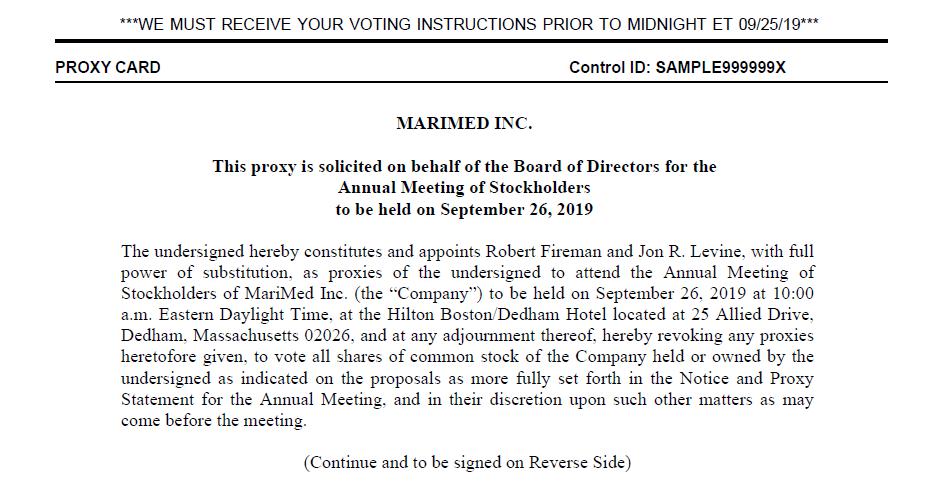

You are invited to attend the 2019 Annual Meeting of Stockholders of MariMed Inc. at 10:00 a.m., Eastern Daylight Time, on September 26, 2019, at the Hilton Boston/Dedham Hotel located at 25 Allied Drive, Dedham, Massachusetts 02026

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the meeting.

It is important that your shares be represented at this meeting to ensure the presence of a quorum. Whether or not you plan to attend the meeting, we hope that you will have your shares represented by signing, dating and returning your proxy in the enclosed envelope, which requires no postage if mailed in the United States, as soon as possible. Your shares will be voted in accordance with the instructions you have given in your proxy.

Thank you for your continued support.

| Sincerely, | |

| |

| Robert Fireman | |

| Chairman, President and Chief Executive Officer |

MARIMED INC.

10 Oceana Way

Norwood, MA 02062

Notice of Annual Meeting of Stockholders

To be held on September 26, 2019

The Annual Meeting of Stockholders of MariMed Inc. (the “Company”) will be held at the Hilton Boston/Dedham Hotel located at 25 Allied Drive, Dedham, Massachusetts 02026, on September 26, 2019 at 10:00 a.m., Eastern Daylight Time, for the purpose of considering and acting upon the following:

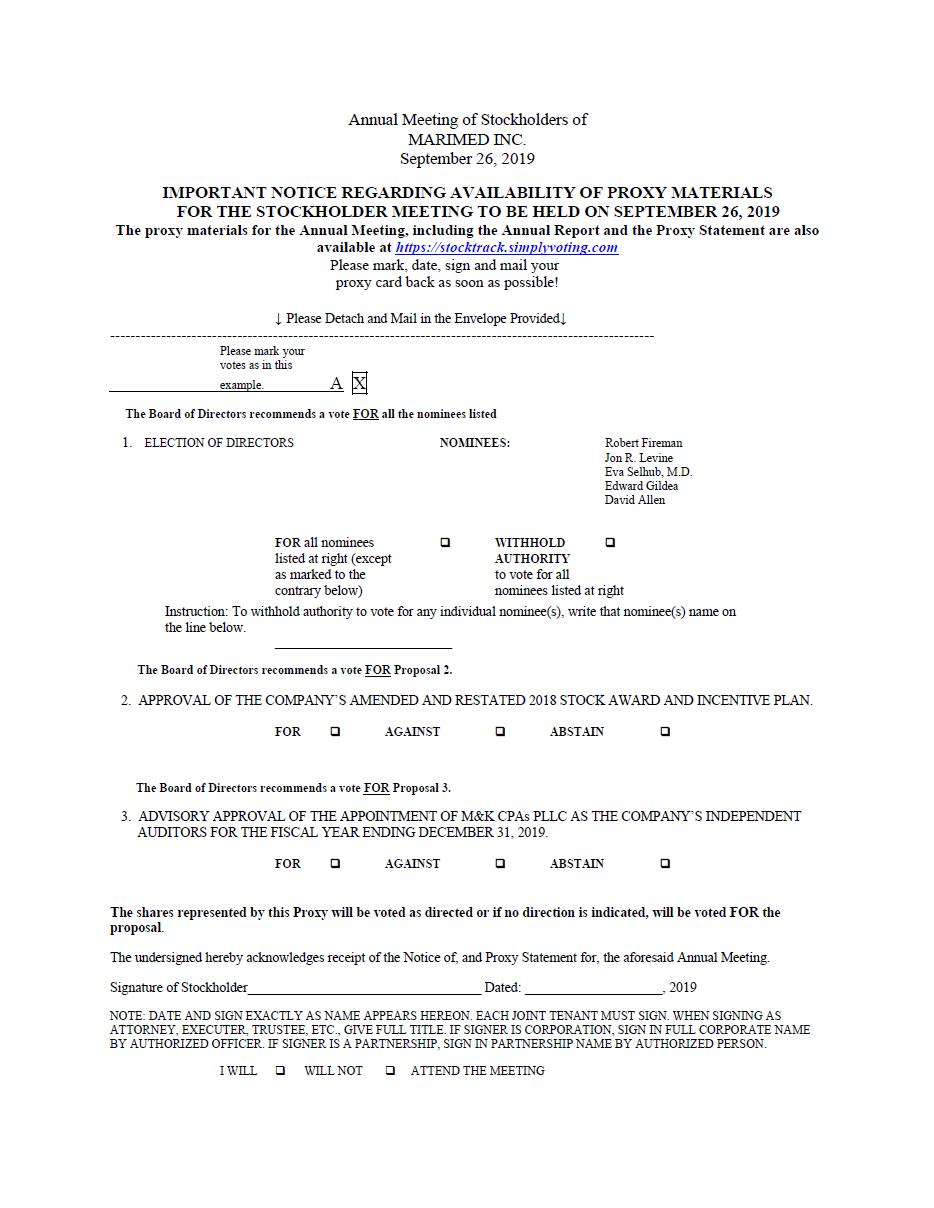

| 1. | The election of five (5) Directors to serve until the next Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified; | |

| 2. | The approval of the Company’s Amended and Restated 2018 Stock Award and Incentive Plan; | |

| 3. | The advisory approval of the appointment of M&K CPAs PLLC as the Company’s independent auditors for the fiscal year ending December 31, 2019; and | |

| 4. | The transaction of such other business as may properly come before the meeting and any adjournment or adjournments thereof. |

Holders of the Company’s outstanding shares of common stock of record at the close of business on August 7, 2019 are entitled to notice of and to vote at the meeting, or any adjournment or adjournments thereof. A complete list of such stockholders will be available for examination by any stockholder at the meeting. The meeting may be adjourned from time to time without notice other than by announcement at the meeting.

| By order of the Board of Directors | |

| |

| Robert Fireman | |

| Chairman, President and Chief Executive Officer | |

| Norwood, Massachusetts | |

| August 26, 2019 |

| IMPORTANT: | IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE. THE PROMPT RETURN OF PROXIES WILL ENSURE A QUORUM AND SAVE THE COMPANY THE EXPENSE OF FURTHER SOLICITATION. EACH PROXY GRANTED MAY BE REVOKED BY THE STOCKHOLDER APPOINTING SUCH PROXY AT ANY TIME BEFORE IT IS VOTED. IF YOU RECEIVE MORE THAN ONE PROXY CARD BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH SUCH PROXY CARD SHOULD BE SIGNED AND RETURNED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED. |

We appreciate your giving this matter your prompt attention.

Important Notice Regarding Availability Of Proxy Materials

For The Annual Meeting of Stockholders To Be Held On September 26, 2019

The proxy materials for the Annual Meeting, including the Annual Report and the Proxy Statement are also available at https://stocktrack.simplyvoting.com

MARIMED INC.

10 Oceana Way

Norwood, MA 02062

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be held on September 26, 2019

Proxies in the form enclosed with this Proxy Statement are solicited by the Board of Directors (the “Board”) of MariMed Inc. (the “Company,” “we,” “us,” “our,” or any derivative thereof) to be used at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Hilton Boston/Dedham Hotel located at 25 Allied Drive, Dedham, Massachusetts 02026, on September 26, 2019 at 10:00 a.m., Eastern Daylight Time, for the purposes set forth in the Notice of Meeting and this Proxy Statement. The Company’s principal executive offices are located at 10 Oceana Way, Norwood, Massachusetts 02062. The approximate date on which this Proxy Statement, the accompanying Proxy and the Company’s Annual Report for the year ended December 31, 2018 will be mailed to stockholders is August 26, 2019.

Important Notice Regarding Availability of Proxy Materials

For The Annual Meeting of Stockholders To Be Held on September 26, 2019

The proxy materials for the Annual Meeting, including the Annual Report and the Proxy Statement are also available at https://stocktrack.simplyvoting.com

THE VOTING AND VOTE REQUIRED

Record Date and Quorum

Only stockholders of record at the close of business on August 7, 2019 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. On the Record Date, we had 218,045,067 shares of common stock, par value $.001 per share (“Common Shares”) outstanding. Each Common Share is entitled to one vote. Common Shares represented by each properly executed, unrevoked proxy received in time for the Annual Meeting will be voted as specified. Common Shares were our only voting securities outstanding on the Record Date. A quorum will be present at the Annual Meeting if stockholders owning a majority of the Common Shares outstanding on the Record Date are present at the meeting in person or by proxy.

Voting of Proxies

The persons acting as proxies (the “Proxyholders”) pursuant to the enclosed Proxy will vote the shares represented as directed in the signed proxy. Unless otherwise directed in the proxy, the Proxyholders will vote the shares represented by the Proxy: (i) for the election of the director nominees named in this Proxy Statement; (ii) for the approval of the Company’s Amended and Restated 2018 Stock Award and Incentive Plan (the “2018 Plan”); (iii) for the advisory approval of the appointment of M&K CPAs PLLC as the Company’s independent auditors for the year ending December 31, 2019 (the “Approval of Auditors”); and (iv) in their discretion, on any other business that may come before the Annual Meeting and any adjournments of the Annual Meeting.

| 1 |

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. All shares represented by valid proxies will be voted in accordance with the instructions contained therein. In the absence of instructions, proxies will be voted FOR each of the stated matters being voted on at the Annual Meeting. A proxy may be revoked by the stockholder giving the proxy at any time before it is voted, by written notice addressed to and received by the Secretary of the Company or Secretary of the meeting, and a prior proxy is automatically revoked by a stockholder giving a subsequent proxy or attending and voting at the Annual Meeting. Attendance at the Annual Meeting, however, in and of itself does not revoke a prior proxy. In the case of the election of directors, shares represented by a proxy which are marked “WITHHOLD AUTHORITY” to vote for all director nominees will not be counted in determining whether a plurality vote has been received for the election of directors. Shares represented by proxies that are marked “ABSTAIN” on any other proposal will not be counted in determining whether the requisite vote has been received for such proposal. However, shares represented by proxies which are marked “WITHHOLD AUTHORITY” or “ABSTAIN” will be counted for quorum purposes.

Broker Non-Votes

A broker non-vote occurs when shares held by a broker are not voted with respect to a particular proposal because the broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients (“broker non-votes”). If your broker holds your shares in its name and you do not instruct your broker how to vote, your broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a broker who has not received instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal. At the Annual Meeting, only the Approval of Auditors (Proposal No. 3) is considered a routine matter. All other proposals are considered “non-routine,” and your broker will not have discretion to vote on those proposals. Broker non-votes will be counted towards determining whether or not a quorum is present.

Voting Requirements

Election of Directors. The election of the five director nominees will require the affirmative vote of a plurality of the votes cast by the holders of Common Shares present in person or represented by proxy to elect each nominee. Election by a plurality means that the director nominee with the most votes for a particular Board seat is elected for that seat.

Approval of the 2018 Plan and Advisory Approval of the Appointment of Independent Auditors. The affirmative vote of a majority of the votes cast on the matter by stockholders entitled to vote at the Annual Meeting is required to approve the 2018 Plan and the appointment of M&K CPAs PLLC as the Company’s independent auditors for the fiscal year ending December 31, 2019. An abstention from voting on approval of auditors will be treated as “present” for quorum purposes. However, since an abstention is not treated as a “vote” for or against the matter, it will have no effect on the outcome of the vote on any of the matters.

Proposal No. 1

ELECTION OF DIRECTORS

Five directors are to be elected at the Annual Meeting. All directors hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified.

It is intended that votes pursuant to the enclosed proxy will be cast for the election of the five nominees named below. In the event that any such nominee should become unable or unwilling to serve as a director, the Proxy will vote for the election of an alternate candidate, if any, as shall be designated by the Board. The Board has no reason to believe these nominees will be unable to serve if elected. Each nominee has consented to being named in this Proxy Statement and to serve if elected. All nominees, except Dr. Eva Selhub, are currently members of our Board. There are no family relationships among any of the executive officers, directors or directors nominees of the Company.

| 2 |

Our director nominees and their respective ages as of the Record Date are as follows:

| Name | Age | Position | ||

| Robert Fireman | 70 | President, Chief Executive Officer and Chairman | ||

| Jon R. Levine | 54 | Chief Financial Officer, Treasurer, Secretary and Director | ||

| Eva Selhub, M.D. | 51 | Director nominee | ||

| David Allen(1) | 64 | Director | ||

| Edward Gildea(2) | 67 | Director |

| (1) | Chairman of the Audit Committee. | |

| (2) | Audit Committee Member. |

Set forth below is a brief description of the background and business experience of our executive officers and directors:

Robert Fireman has served as our president and chief executive officer since July 2017. In addition, Mr. Fireman has been a director since our formation, and is a seasoned executive in the building of technology and consumer driven companies. Mr. Fireman was a founder and Director of Consumer Card Marketing, Inc., a pioneer in the development of retail loyalty marketing programs for the supermarket and drug store industries. This company was sold to News America Marketing, a division of News Corp. Mr. Fireman has been a practicing attorney for over 30 years. Mr. Fireman is also the CEO of our wholly-owned subsidiary, MariMed Advisors Inc., a director of Worlds Inc. and a former part owner of Sigal Consulting LLC. He has over ten years of experience in the emerging cannabis industry across the country. In February 2019, Mr. Fireman was appointed to GenCanna Inc.’s board of directors.

Jon R. Levine has served as our chief financial officer, treasurer, and secretary since July 2017 and has been a director since 2016. Mr. Levine has over nine years of experience in the cannabis industry. He brings over 18 years in commercial real estate development, management and financial services experience. Mr. Levine was a partner at Equity Industrial Partners, a national commercial real estate management group. He also has past experience in banking at USTrust Bank as an Asset Based Lender and in the leasing industry with AT&T Financial Services and New Court Financial as a senior credit officer. Mr. Levine also serves as the CFO of our wholly-owned subsidiary, MariMed Advisors Inc., and in that capacity he has been responsible for the management and reporting of most of the company’s revenue and financial transactions. Mr. Levine is a former part owner of Sigal Consulting LLC.

Eva Selhub, M.D., a director nominee, is a board-certified physician, speaker, scientist, executive leadership and performance coach, consultant in the field of corporate wellness and resilience, and an author. From August 1997 to November 2016, she served as an instructor and lecturer of medicine at Harvard Medical School. During this period, Dr. Selhub simultaneously held other positions at Tufts University, Massachusetts General Hospital, as well as other professional healthcare/medical organizations. From October 2006 to October 2017, she was a senior physician at Benson Henry Institute for Mind/Body Medicine at Massachusetts General Hospital. From August 2016 to present, she has been an adjunct scientist of neuroscience at Jean Mayer USDA Human Nutrition Research Center on Aging at Tufts University, one of six human nutrition research centers supported by the United States Department of Agriculture. Dr. Selhub received a Bachelor of Arts degree in anthropology from the Tufts University in 1989 and her M.D. degree from Boston University School of Medicine in 1994. Dr. Selhub’s professional experience and background as a physician, scientist and in mind-body medicine will allow her to make valuable contributions to the Board and provide expertise to serve as one of our directors.

| 3 |

David Allen, has been a director since June 2019. He brings over 22 years of experience as a Director, CEO and CFO of public companies. Presently he serves as Chief Financial Officer of Charlie’s Holdings, Inc. (formerly known as True Drinks Holdings, Inc.). From September 2018 to May 2019, Mr. Allen served as Chief Financial Officer of Iconic Brands, Inc. Prior to that, from December 2014 to January 2018, Mr. Allen served as the Chief Financial Officer of WPCS International, Inc. From 2004 to 2017, Mr. Allen served as Chief Financial Officer of Bailey’s Express, Inc., a privately held trucking corporation, which filed for Chapter 11 bankruptcy in July 2017. Mr. Allen currently serves as the Chapter 11 Plan Administrator for the bankruptcy case. From June 2006 to June 2013, Mr. Allen served as the Chief Financial Officer and Executive Vice President of Administration at Converted Organics, Inc., after serving as audit committee chair of the board of Converted Organics. Mr. Allen is currently an Assistant Professor of Accounting at Southern Connecticut State University (SCSU), a position he has held since 2017. For the 12 years prior, he was an Adjunct Professor of Accounting at SCSU and Western Connecticut State University. Mr. Allen is a licensed CPA and holds a bachelor’s degree in Accounting and a master’s degree in Taxation from Bentley College. Mr. Allen’s background as a Director, CEO and CFO of public companies will allow him to make valuable contributions to the Board.

Edward. Gildea has been a director since our formation. Since February 2014, Mr. Gildea has been a partner in the law firm Fisher Broyles LLP. From 2006 to 2013, Mr. Gildea was President, Chief Executive Officer and Chairman of Converted Organics Inc., a publicly held green technology company that manufactured and sold an organic fertilizer, made from recycled food waste. Mr. Gildea contributes expertise in areas of mergers & acquisitions, strategic planning, funding, business development, and executive leadership. Mr. Gildea received a B.A. from The College of the Holy Cross and a J.D. from Suffolk University Law School. Mr. Gildea’s executive business experience was instrumental in his selection as a member of the Board.

The Board recommends a vote FOR the election of each of the director nominees

and proxies that are signed and returned will be so voted

unless otherwise instructed.

* * * * *

| 4 |

EXECUTIVE OFFICERS

The following table identifies our current executive officers:

| Name | Age | Capacity in Which Served | In Current Position Since | |||

| Robert Fireman (1) | 70 | President, Chief Executive Officer and Chairman | 2017 | |||

| Jon R. Levine (1) | 54 | Chief Financial Officer, Treasurer, Secretary and Director | 2017 |

| (1) | Biographical information with respect to Messrs. Robert Fireman and Jon R. Levine is provided above. |

Code of Ethics

We have adopted a code of ethic (the “Code of Ethics”) that applies to our principal chief executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the Code of Ethics was filed as Exhibit 14.1 to a previous annual report and is posted on our website. The Code of Ethics was designed with the intent to deter wrongdoing, and to promote the following:

| ● | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| ● | Full, fair, accurate, timely and understandable disclosure in reports and documents that we file with, or submit to, the Securities and Exchange Commission (“SEC”) and in other public communications we make; |

| ● | Compliance with applicable governmental laws, rules and regulations; |

| ● | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

| ● | Accountability for adherence to the code. |

Director Independence

The Board has determined that Messrs. Edward Gildea and David Allen, and Dr. Eva Selhub are independent and represent a majority of its members. In determining director independence, the Board applies the independence standards set by the Nasdaq Stock Market (“NASDAQ”). In applying these standards, our Board considers all transactions with the independent directors and the impact of such transactions, if any, on any of the independent directors’ ability to continue to serve on our Board.

Board Committees

On August 15, 2019, the Common Shares began trading on the OTCQX® Best Market (“OTCQX”) tier of the OTC Markets Group. As such, with the exception of an audit committee, the Board is not required to establish any committees typically required of companies listed on the NASDAQ or other stock exchanges. On August 14, 2019, the Board established an audit committee (the “Audit Committee”) and appointed David Allen and Edward Gildea as committee members. Messrs. Allen and Gildea are both independent directors as such term is defined in section 5605(a)(2) of the NASDAQ rules. Mr. Allen was also appointed as the chairman of the Audit Committee and qualifies as the “audit committee financial expert” pursuant to Item 407(d)(5) of Regulations S-K.

With exception of the Audit Committee, the Board has not established any other committees of the Board. However, the Board has the authority to appoint committees to perform certain management and administrative functions, and intends to also establish a compensation committee (the “Compensation Committee”) and a corporate governance and nominating committee (the “Corporate Governance and Nominating Committee”). The Audit Committee has, and the Board expects that the Compensation Committee and the Corporate Governance and Nominating Committee will have, the responsibilities described below and be made up entirely of independent directors as such term is defined in section 5605(a)(2) of the NASDAQ rules. As of the date hereof, the responsibilities that will be delegated to the Compensation Committee and the Corporate Governance and Nominating Committee rest with the entire Board.

| 5 |

Audit Committee. The Audit Committee oversees our accounting and financial reporting processes, internal systems of accounting and financial controls, relationships with auditors and audits of financial statements. Specifically, the Audit Committee’s responsibilities include the following:

● selecting, hiring and terminating our independent auditors;

● evaluating the qualifications, independence and performance of our independent auditors;

● approving the audit and non-audit services to be performed by the independent auditors;

● reviewing the design, implementation and adequacy and effectiveness of our internal controls and critical policies;

● overseeing and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and other accounting matters;

● with management and our independent auditors, reviewing any earnings announcements and other public announcements regarding our results of operations; and

● preparing the report that the SEC requires in our annual proxy statement.

A copy of the Audit Committee charter is available on our website at www.marimedinc.com.

Compensation Committee. The Compensation Committee will assist the Board in determining the compensation of our officers and directors. The Compensation Committee will be comprised entirely of directors who satisfy the standards of independence applicable to Compensation Committee members established under 162(m) of the Code and Section 16(b) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). Specific responsibilities will include the following:

● approving the compensation and benefits of our executive officers;

● reviewing the performance objectives and actual performance of our officers; and

● administering our stock option and other equity and incentive compensation plans.

| 6 |

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will assist the Board by identifying and recommending individuals qualified to become members of the Board. Specific responsibilities will include the following:

● evaluating the composition, size and governance of our Board and its committees and making recommendations regarding future planning and the appointment of directors to our committees;

● establishing a policy for considering stockholder nominees to our Board;

● reviewing our corporate governance principles and making recommendations to the Board regarding possible changes; and

● reviewing and monitoring compliance with our code of ethics and insider trading policy.

During fiscal year 2018, the Board held one (1) meeting and all directors then in office were in attendance. It is the Company’s policy that directors are invited and encouraged to attend the Annual Meeting.

Audit Committee Report

During the year ended December 31, 2018, we did not have a separately designated standing audit committee. Pursuant to Section 3(a)(58)(B) of the Exchange Act, the entire Board acted as the audit committee for the purpose of overseeing the accounting and financial reporting processes, and audits of our financial statements.

The Board retained our independent registered public accounting firm and approves in advance all permissible non-audit services performed by them and other auditing firms. Although management has the primary responsibility for the financial statements and the reporting process including the systems of internal control, the Board consulted with management and our independent registered public accounting firm regarding the preparation of financial statements, the adoption and disclosure of our critical accounting estimates and generally oversaw our relationship with our independent registered public accounting firm.

The Board reviewed our audited financial statements for the year ended December 31, 2018 and met with management to discuss such audited financial statements. The Board has discussed with M&K CPAs PLLC (“M&K”), our independent accountants, the matters required to be discussed pursuant to applicable auditing standards. The Board has received the written disclosures and the letter from M&K required by the Public Company Accountant Oversight Board regarding the independent accountant’s communications with the Board concerning independence and has discussed with M&K its independence from us and our management. M&K had full and free access to the Board. Based on its review and discussions, the Board recommended that our audited financial statements for the year ended December 31, 2018 be included in our Annual Report on Form 10-K for the year then ended for filing with the SEC.

| AUDIT COMMITTEE: | |

| David Allen | |

| Edward Gildea |

The above report is not deemed to be “soliciting material,” and is not “filed” with the SEC.

| 7 |

Board Nominations

Currently, we do not have a separately designated standing nominating committee. The entire Board acts as the nominating committee for the purposes of identifying and recommending director candidates. The Board is responsible for nominating director candidates for the annual meeting of stockholders each year and will consider director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Board will take into consideration the needs of the Board and the qualifications of the candidate. The Board may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. To have a candidate considered by the Board, a stockholder must submit the recommendation in writing and must include the following information: (i) the name of the stockholder and evidence of the person’s ownership of Company stock, (including the number of shares owned and the length of time of ownership); (ii) the name of the candidate; (iii) the candidate’s resume or a listing of his or her qualifications to be a director of the Company; and (iv) the person’s consent to be named as a director if selected and nominated by the Board.

The information described above must be sent to the Company’s Chief Financial Officer at 10 Oceana Way, Norwood, Massachusetts 02062, on a timely basis in order to be considered by the Nominating and Corporate Governance Committee, within the time periods set forth in the “Stockholder Proposals” section below.

The Board may also receive suggestions from current Company directors, executive officers or other sources, which may be either unsolicited or in response to requests from the Board for such candidates. The Board also, from time to time, may engage firms that specialize in identifying director candidates.

Once a person has been identified by the Board as a potential candidate, it may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Board determines that the candidate warrants further consideration, the Chairman or another member of the Board may contact the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Board may request information from the candidate, review the person’s accomplishments and qualifications and may conduct one or more interviews with the candidate. The Board may consider all such information in light of information regarding any other candidates that the Board might be evaluating for membership on the Board. In certain instances, the Board may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Board’s evaluation process does not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

Disclosure of Director Qualifications

The Board is responsible for assembling for stockholder consideration a group of nominees that, taken together, have the experience, qualifications, attributes, and skills appropriate for functioning effectively as a Board.

The Board believes that the minimum qualifications for service as a director are that a nominee possess an ability, as demonstrated by recognized success in his or her field, to make meaningful contributions to the Board’s oversight of the business and affairs of the Company and an impeccable reputation of integrity and competence in his or her personal or professional activities. The Board’s criteria for evaluating potential candidates include the following: (i) an understanding of the Company’s business environment, (ii) the possession of such knowledge, skills, expertise and diversity of experience that would enhance the Board’s ability to manage and direct the affairs and business of the Company and (iii) certain characteristics common to all Board members, including integrity, strong professional reputation and record of achievement, constructive and collegial personal attributes, and the ability and commitment to devote sufficient time and energy to Board service.

| 8 |

In addition, the Board seeks to include on the Board a complementary mix of individuals with diverse backgrounds and skills reflecting the broad set of challenges that the Board confronts.

Board Leadership Structure

Robert Fireman has served as Chairman of the Board and Chief Executive Officer since July 2017. According to our By-Laws the roles of Chairman of the Board and Chief Executive Officer are held by the same person. Our Board regularly evaluates our leadership structure and determines the most appropriate structure based upon its assessment of our position, strategy, and our long-term plans. The Board also considers the specific circumstances we face and the characteristics and membership of the Board. At this time, the Board has determined that having Robert Fireman serve as both the Chairman and Chief Executive Officer is in the best interest of our stockholders. We believe this structure makes the best use of the Chief Executive Officer’s extensive knowledge of our business and personnel, our strategic initiatives and our industry, and also fosters real-time communication between management and the Board.

The Board’s Oversight of Risk Management

The Board recognizes that all companies face a variety of risks, including credit risk, liquidity risk, strategic risk, and operational risk. The Board believes an effective risk management system will (1) timely identify the material risks that we face, (2) communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee, (3) implement appropriate and responsive risk management strategies consistent with our risk profile, and (4) integrate risk management into our decision-making. The Board encourages, and management promotes, a corporate culture that incorporates risk management into our corporate strategy and day-to-day business operations. The Board also continually works, with the input of our management and executive officers, to assess and analyze the most likely areas of future risk for us.

Communications with Directors

The Board has established a process to receive communications from stockholders. Stockholders and other interested parties may contact any member (or all members) of the Board, or the non-management directors as a group by mail or electronically. To communicate with the Board, any individual director or any group of directors, correspondence should be addressed to the Board or any such individual directors or group of directors by either name or title. All such correspondence should be sent to c/o Secretary, MariMed Inc., 10 Oceana Way, Norwood, Massachusetts 02062.

All communications received as set forth in the preceding paragraph will be opened by the Secretary of the Company for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, patently offensive material or matters deemed inappropriate for the Board will be forwarded promptly to the addressee. In the case of communications to the Board or any group of directors, the Secretary will make sufficient copies of the contents to send to each director who is a member of the group to which the envelope or e-mail is addressed.

| 9 |

COMPENSATION OF DIRECTORS

In 2018, the Board adopted a resolution to cease the practice of granting options to non-employee directors as compensation for serving on the Board, until such time as the Board reconsiders the compensation of non-employee directors following the stockholders’ vote in connection with the 2018 Plan, anticipated to take place at the Annual Meeting. Previous to this resolution, a non-employee director received compensation in the form of five-year non-qualified stock options to purchase (i) 100,000 Common Shares for each year of service as a non-employee director, and (ii) 150,000 Common Shares upon first joining the Board.

The following table sets forth information concerning the compensation paid to each of our non-employee directors during 2018 for their services rendered as directors.

| Name | Fees Earned or Paid in Cash | Stock Awards | Option Awards |

Total ($) | ||||||||||||

| Bernard Stolar (1) | $ | 0 | $ | 0 | $ | 120,171 | $ | 120,171 | ||||||||

| Edward Gildea (2) | $ | 0 | $ | 0 | $ | 120,171 | $ | 120,171 | ||||||||

| David Allen (3) | $ | 0 | $ | 0 | - | - | ||||||||||

| Thomas Kidrin (4) | $ | 0 | $ | 0 | $ | 60,801 | $ | 60,801 | ||||||||

| (1) | Mr. Stolar will not be standing for re-election as a director at the Annual Meeting. He held 100,000 stock options at December 31, 2018. | |

| (2) | Mr. Gildea held 650,000 stock options at December 31, 2018. | |

| (3) | Mr. Allen was appointed to the Board on June 25, 2019. | |

| (4) | Mr. Kidrin resigned from the Board as of June 5, 2019. He held 100,000 stock options at December 31, 2018. |

Executive Compensation

The following table sets forth the compensation paid by us during the fiscal periods ending December 31, 2018 and 2017, to our chief executive officer and chief financial officer (the ‘‘Named Executives’’).

SUMMARY COMPENSATION TABLE(1)(2)

| Name and principal position | Year | Salary | Bonus | Stock Awards | Option Awards(5) | All

Other Compensa-tion | Total | |||||||||||||||||||||

| Robert Fireman | 2018 | $ | 0 | $ | 10,000 | $ | 0 | $ | 70,164 | $ | 0 | $ | 80,164 | |||||||||||||||

| President and CEO (3) | 2017 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||||||

| Jon R. Levine | 2018 | $ | 0 | $ | 10,000 | $ | 0 | $ | 86,355 | $ | 0 | $ | 96,355 | |||||||||||||||

| CFO (4) | 2017 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||||||

| (1) | The compensation reported on the Table does not include other personal benefits, the total value of which do not exceed $10,000. |

| (2) | Pursuant to the regulations promulgated by the SEC, the table omits columns reserved for types of compensation not applicable to us. |

| (3) | Mr. Fireman was named President and CEO of the Company in July 2017. |

| (4) | Mr. Levine was named CFO of the Company in July 2017. |

| (5) | Amounts represent the fair value of option awards valued on grant date using the Black-Scholes pricing model and recognized for financial reporting purposes during the year ended December 31, 2018. |

| 10 |

Stock Option Grants

The following table sets forth information as of December 31, 2018 concerning unexercised options, unvested stock and equity incentive plan awards for the Named Executives.

OUTSTANDING EQUITY AWARDS AT YEAR-ENDED DECEMBER 31, 2018

| Name | Number

of Securities Underlying Unexercised Options Exercisable (#) |

Number

of Securities Underlying Unexercised Options Unexercisable (#) |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options |

Option Exercise Price ($) |

Option Expiration Date | |||||||||||||

| Robert Fireman | 100,000 | - | - | $ | 0.08 | 12/20/19 | ||||||||||||

| Robert Fireman | 100,000 | - | - | $ | 0.13 | 06/29/20 | ||||||||||||

| Robert Fireman | 100,000 | - | - | $ | 0.14 | 12/31/19 | ||||||||||||

| Robert Fireman | 100,000 | - | - | $ | 0.14 | 12/31/20 | ||||||||||||

| Robert Fireman | 100,000 | - | - | $ | 0.63 | 12/31/21 | ||||||||||||

| Jon R. Levine | 250,000 | - | - | $ | 0.14 | 12/31/20 | ||||||||||||

| Jon R. Levine | 100,000 | - | - | $ | 0.14 | 12/31/20 | ||||||||||||

| Jon R. Levine | 100,000 | - | - | $ | 0.63 | 12/31/21 | ||||||||||||

| 11 |

PROPOSAL 2

APPROVAL OF THE AMENDED AND RESTATED 2018 STOCK AWARD AND INCENTIVE PLAN

Introduction

At our Annual Meeting, we will ask stockholders to approve the Amended and Restated 2018 Stock Award and Incentive Plan (the “2018 Plan”). Our Board approved the 2018 Plan on August 14, 2019, subject to the approval of our stockholders.

The 2018 Plan is an “omnibus” plan, authorizing a variety of equity award types as well as cash and long-term incentive awards. We intend that the 2018 Plan will amend and restate the 2018 Stock Award and Incentive Plan (the “Original Plan”), which was approved by our Board on July 10, 2018, but never presented to stockholders for approval. Any grants made under the Original Plan prior to the date of the Board’s approval of the 2018 Plan shall continue to be governed by the terms of the original plan.

The Board and its Compensation Committee (the “Committee”) will seek to use the 2018 Plan to help us:

| ● | Attract, retain, motivate and reward employees, non-employee directors and other persons who provide substantial services to the Company and its affiliates. | |

| ● | Provide equitable and competitive compensation opportunities. | |

| ● | Incentivize outstanding Company and individual performance with appropriate limitations on risk. | |

| ● | Promote creation of long-term value for stockholders by closely aligning the interests of participants with the interests of stockholders and thereby promote the success of the Company’s business. |

The Board and the Committee believe that awards linked to Common Shares provide incentives for the achievement of important performance objectives and promote the long-term success of MariMed. Therefore, they view the 2018 Plan as a key part of our overall compensation program.

Shares To Be Available under Our Equity Compensation Plans

Information on the total number of shares available under our existing equity compensation plan and unissued shares deliverable under outstanding options as of the end of the last fiscal year is presented below under the caption “Company Equity Compensation Plans.”

| 12 |

The following table shows the aggregate number of shares subject to currently outstanding equity awards under the 2011 Stock Option and Restricted Stock Award Plan (the “2011 Plan”) and the 2018 Plan (our only current equity award plans) as of June 30, 2019 together with the shares that will be subject to outstanding awards and available for future awards if, at that date, the 2018 Plan were approved by stockholders and effective. If this proposal is approved, no further awards will be granted under the 2011 Plan, but awards will remain outstanding under the 2011 Plan and shares may be recycled in some cases if shares are not delivered to a participant under such awards:

Existing 2011 Plan:

| Shares subject to outstanding awards (1) | 3,350,000 |

Existing 2018 Plan:

| Shares subject to outstanding awards (2) | 4,540,000 | |||

| Shares to be available for future awards (3) | 34,965,000 | |||

| Total number of shares subject to outstanding awards and available for future awards under both plans | 42,855,000 | |||

| Approximate percentage of outstanding shares (diluted) (4) | 19.9 percent |

| (1) | Includes 3,350,000 outstanding stock options with a weighted average exercise price of $0.24 and a weighted average remaining term of two (2) months. | |

| (2) | Includes 4,540,000 outstanding stock options with a weighted average exercise price of $1.83 and a weighted average remaining term of four (4) years. | |

| (3) | Assuming stockholder approval of the proposed 2018 Plan, the number of shares available for future awards would be the number set forth in this table. The shares would be available for all types of awards. | |

| (4) | Calculated based on the total number of shares subject to outstanding awards and available for future awards under both the 2011 Plan and 2018 Plan (42,855,000 shares) divided by (a) the number of Common Shares outstanding as of June 30, 2019 (215,591,103 shares), plus (b) the total number of shares subject to outstanding awards and available for future awards under both the 2011 Plan and 2018 Plan (42,855,000). |

Overview of 2018 Plan Awards

The 2018 Plan authorizes a broad range of awards, including:

| ● | stock options; |

| ● | stock appreciation rights (“SARs”); |

| ● | restricted stock, a grant of actual shares subject to a risk of forfeiture and restrictions on transfer; |

| ● | deferred stock, a contractual commitment to deliver shares at a future date; the award may or may not be subject to a risk of forfeiture (we generally refer to forfeitable deferred stock as “restricted stock units,” but may be called “stock units,” “phantom shares” or by another name); |

| ● | other awards based on Common Shares; |

| ● | dividend equivalents; |

| ● | performance shares or other stock-based performance awards (these include deferred stock or restricted stock awards that may be earned by achieving specific performance objectives); |

| ● | cash-based performance awards tied to achievement of specific performance objectives; and |

| ● | shares issuable in lieu of rights to cash compensation. |

| 13 |

Reasons for Stockholder Approval

We seek approval of the 2018 Plan by stockholders as desirable and consistent with corporate governance best practices.

Restriction on Repricing; Reload Options; Loans

The 2018 Plan includes a restriction providing that, without stockholder approval, we will not amend or replace options or SARs previously granted under the 2018 Plan in a transaction that constitutes a “repricing.” For this purpose, a “repricing” is defined as amending the terms of an outstanding option or SAR, including by means of a 2018 Plan amendment, to lower its exercise price, any other action that is treated as a repricing under generally accepted accounting principles or canceling an option or SAR at a time that its exercise price is equal to or greater than the fair market value of the underlying stock in exchange for another option, SAR, restricted stock, other equity, cash or other property, unless the cancellation and exchange occurs in connection with a merger, acquisition, spin-off or other similar corporate transaction. Adjustments to the exercise price or number of shares subject to an option or SAR to account for the effects of a stock split or other extraordinary corporate transaction will not constitute a “repricing.”

In addition, the 2018 Plan:

| ● | provides that no term of an option or SAR can provide for automatic “reload” grants of additional awards upon exercise; and | |

| ● | prohibits personal loans from MariMed to a participant for payment of the exercise price or withholding taxes relating to any equity award. |

Description of the 2018 Plan

The following is a brief description of the material features of the 2018 Plan. This description, including information summarized above, is qualified in its entirety by reference to the full text of the proposed 2018 Plan, a copy of which is attached to this Proxy Statement as Appendix A.

Shares Available under the 2018 Plan. Under the 2018 Plan, 40,000,000 shares are reserved for delivery to participants. Shares used for awards assumed in an acquisition do not count against the shares reserved under the 2018 Plan. The shares reserved may be used for any type of award under the 2018 Plan.

The 2018 Plan applies the following rules for counting shares and recapturing shares not delivered in connection with 2018 Plan awards: Shares actually delivered to participants in connection with an award will be counted against the number of shares reserved under the 2018 Plan. Shares will remain available for new awards if an award under the 2018 Plan expires, is forfeited, canceled, or otherwise terminated without delivery of shares or is settled in cash. Upon exercise of an option or SAR for shares, the number of shares deemed to be delivered under the Plan will be the full number of shares underlying the exercised award, regardless of any net delivery or any withholding of shares for taxes. Likewise, shares withheld from an award other than an option or SAR (sometimes referred to as a “full-value award”) in payment of taxes will be deemed to have been delivered under the 2018 Plan. Under the 2018 Plan, awards may be outstanding relating to a greater number of shares than the aggregate remaining available so long as the Committee ensures that awards will not result in delivery and vesting of shares in excess of the number then available under the 2018 Plan. Shares delivered under the 2018 Plan may be either newly issued or treasury shares.

| 14 |

On August 16, 2019, the closing price of Common Shares on the OTCQX was $1.49 per share.

Adjustments. Adjustments to the number and kind of shares subject to the share limitations (including annual per-person limits) are authorized in the event of a large and non-recurring dividend or distribution, recapitalization, stock split, stock dividend, reorganization, business combination, other similar corporate transaction, equity restructuring as defined under applicable accounting rules, or other similar event affecting the Common Shares. We are also obligated to adjust outstanding equity awards (and share-related performance terms, such as share-price targets) upon the occurrence of these types of events to preserve, without enlarging, the rights of the 2018 Plan participants with respect to their awards. The Committee may adjust performance conditions and other terms of awards in response to these kinds of events or to changes in applicable laws, regulations, or accounting principles.

Eligibility. Employees of MariMed and its affiliates, including officers, non-employee directors of MariMed, and consultants and others who provide substantial services to MariMed and its affiliates, are eligible to be granted awards under the 2018 Plan. As of June 30, 2019, approximately 45 persons were potentially eligible for awards under the 2018 Plan.

Administration. The Committee administers the 2018 Plan, except that the Board may itself act to administer the 2018 Plan, and the Board will approve awards to non-employee directors. References to the “Committee” here mean the Committee or the full Board exercising authority with respect to a given award. The 2018 Plan provides that the composition and governance of the Committee is established in the Committee’s charter adopted by the Board. Subject to the terms and conditions of the 2018 Plan, the Committee is authorized to select participants, determine the type and number of awards to be granted and the number of shares to which awards will relate or the amount of a performance award, specify times at which awards will become vested or exercisable or be settled, including performance conditions that may be required for the award to be earned, set other terms and conditions of awards, prescribe forms of award agreements, interpret and specify rules and regulations relating to the 2018 Plan, and make all other determinations that may be necessary or advisable for the administration of the 2018 Plan.

Nothing in the 2018 Plan precludes the Committee from authorizing payment of other compensation, including bonuses based upon performance, to officers and employees, including the executive officers, outside of the 2018 Plan. The 2018 Plan authorizes the Committee to delegate authority to executive officers to the extent permitted by applicable law, but such delegation will not authorize grants of awards to executive officers without the participation by the Committee. The 2018 Plan provides that members of the Committee and the Board will not be personally liable, and will be fully indemnified, in connection with any action, determination or interpretation taken or made in good faith under the Plan.

Stock Options and SARs. The Committee is authorized to grant stock options, including both incentive stock options (“ISOs”), which can result in potentially favorable tax treatment to the participant, and non-qualified stock options. SARs may also be granted, entitling the participant to receive the excess of the fair market value of a share on the date of exercise over the SAR’s designated exercise price. The exercise price of an option or SAR is determined by the Committee, but may not be less than the fair market value of the underlying shares on the date of grant. The maximum term of an option or SAR is ten years. Subject to this limit, the times at which each option or SAR will be exercisable and provisions requiring forfeiture of unvested or unexercised options (and in some cases gains realized upon an earlier exercise) at or following termination of employment or upon the occurrence of other events generally are fixed by the Committee. Options may be exercised by payment of the exercise price in cash, shares having a fair market value equal to the exercise price or surrender of outstanding awards or other property having a fair market value equal to the exercise price, as the Committee may determine. This may include withholding of option shares to pay the exercise price. The Committee also is permitted to establish procedures for broker-assisted cashless exercises. SARs may be exercisable for shares or for cash, as determined by the Committee, and the method of exercise and settlement and other and other terms of SARs will be determined by the Committee.

| 15 |

Restricted and Deferred Stock/Restricted Stock Units. The Committee is authorized to grant restricted stock and deferred stock. Prior to the end of the restricted period, shares granted as restricted stock may not be sold, and will be forfeited in the event of termination of employment in specified circumstances. The Committee will establish the length of the restricted period for awards of restricted stock. Aside from the risk of forfeiture and non-transferability, an award of restricted stock entitles the participant to the rights of a stockholder of MariMed, including the right to vote the shares and to receive dividends (which may be forfeitable or non-forfeitable), unless otherwise determined by the Committee.

Deferred stock gives a participant the right to receive shares at the end of a specified deferral period. Deferred stock subject to forfeiture conditions may be denominated as an award of restricted stock units. The Committee will establish any vesting requirements for deferred stock/restricted stock units granted for continuing services. One advantage of restricted stock units, as compared to restricted stock, is that the period during which the award is deferred as to settlement can be extended past the date the award becomes non-forfeitable, so the Committee can require or permit a participant to continue to hold an interest tied to Common Shares on a tax-deferred basis. Prior to settlement, deferred stock awards, including restricted stock units, carry no voting or dividend rights or other rights associated with stock ownership, but dividend equivalents (which may be forfeitable or, if the award does not have performance conditions, non-forfeitable) will be paid or accrue if authorized by the Committee, as further described below.

Other Stock-Based Awards, Stock Bonus Awards, and Awards in Lieu of Other Obligations. The 2018 Plan authorizes the Committee to grant awards that are denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to Common Shares. The Committee will determine the terms and conditions of such awards, including the consideration to be paid to exercise awards in the nature of purchase rights, the periods during which awards will be outstanding, and any forfeiture conditions and restrictions on awards. In addition, the Committee is authorized to grant shares as a bonus free of restrictions, or to grant shares or other awards in lieu of obligations under other plans or compensatory arrangements, subject to such terms as the Committee may specify.

Performance-based Awards. The Committee may grant performance awards, which may be awards of a specified cash amount or may be share-based awards. Generally, performance awards require satisfaction of pre-established performance goals, consisting of one or more business criteria and a targeted performance level with respect to such criteria as a condition of awards being granted or becoming exercisable or settleable, or as a condition to accelerating the timing of such events. Performance may be measured over a period of any length specified by the Committee.

The Committee retains discretion to set the level of performance for a given business criteria that will result in the earning of a specified amount under a performance award. These goals may be set with fixed, quantitative targets, targets relative to our past performance, targets compared to the performance of other companies, such as a published or special index or a group of companies selected by the Committee for comparison, or in such other way as the Committee may determine. The Committee may specify that these performance measures will be determined before payment of bonuses, capital charges, non-recurring or extraordinary income or expense, or other financial and general and administrative expenses for the performance period.

Vesting, Forfeitures, and Related Award Terms; Change in Control. The Committee has discretion in setting the vesting schedule of options, SARs, restricted stock, deferred stock and other awards, the circumstances resulting in forfeiture of awards, the post-termination exercise periods of options, SARs and similar awards, and the events resulting in acceleration of the right to exercise and the lapse of restrictions, or the expiration of any deferral period, on any award.

| 16 |

Upon a “Change in Control,” the Committee can allow awards to remain outstanding or be assumed by a successor. This could include converting awards to become a right to receive the cash or property received by stockholders in the Change in Control. If awards continue or are assumed without an acceleration of vesting, the participant will have “double-trigger” protection if permitted by our regulators. If, however, the Committee does not provide for awards to be continued or assumed, or if double-trigger protective terms are barred by law or regulation at the time of the Change in Control, the awards will immediately vest and become exercisable or otherwise be paid out. In such case, if options or SARs are not “in-the-money,” they will be canceled with no consideration paid to the participant.

Other Terms of Awards. Awards may be settled in cash, shares, other awards or other property, in the discretion of the Committee. The Committee may require or permit participants to defer the settlement of all or part of an award, in accordance with such terms and conditions as the Committee may establish, including payment or crediting of interest or dividend equivalents on any deferred amounts. The Committee is authorized to place cash, shares or other property in trusts or make other arrangements to provide for payment of our obligations under the 2018 Plan. The Committee may condition awards on the payment of taxes, and may provide for mandatory or elective withholding of a portion of the shares or other property to be distributed in order to satisfy tax obligations. Awards granted under the 2018 Plan generally may not be pledged or otherwise encumbered and are not transferable except by will or by the laws of descent and distribution, or to a designated beneficiary upon the participant’s death, except that the Committee may permit transfers of awards other than ISOs on a case-by-case basis, but such transfers may not be to third parties for value.

The 2018 Plan authorizes the Committee to provide for forfeiture of awards and recoupment or “claw back” of award gains in the event a participant fails to comply with conditions relating to non-competition, non-solicitation, confidentiality, non-disparagement and other requirements for the protection of the our business, or adhering to standards of conduct in the preparation of financial statements and reports filed with the SEC, and for similar forfeitures if the attained level of performance was based on material inaccuracies in the financial or other information. Each award under the 2018 Plan will be subject to our claw back policy, as in effect at the time of grant of the award. Awards under the 2018 Plan may be granted without a requirement that the participant pay consideration in the form of cash or property for the grant (as distinguished from the exercise), except to the extent required by law. The Committee may, however, grant awards in substitution for, exchange for or as a buyout of other awards under the 2018 Plan, awards under our plans, or other rights to payment from us, and may exchange or buy out outstanding awards for cash or other property subject to the requirement that repricing of underwater options and SARs must be approved by stockholders. The Committee also may grant awards in addition to and in tandem with other awards, awards, or rights. In granting a new award, the Committee may determine that the in-the-money value or fair value of any surrendered award may be applied to reduce the purchase price of any new award, subject to the requirement that repricing transactions must be approved by stockholders.

Dividend Equivalents. The Committee may grant dividend equivalents. These are rights to receive payments equal in value to the amount of dividends paid on a specified number of Common Shares while an award is outstanding. These amounts may be in the form of cash or rights to receive additional awards or additional shares having a value equal to the cash amount. The awards may be granted on a stand-alone basis or in conjunction with another award, and the Committee may specify whether the dividend equivalents will be forfeitable or non-forfeitable, except as noted below for performance-based awards. Rights to dividend equivalents may be granted in connection with restricted stock units or deferred stock, so that the participant can earn amounts equal to dividends paid on the number of shares covered by the award while the award is outstanding. Dividend equivalents relating to a performance-based award will be earnable only upon the achievement of the performance goals applicable to the award.

| 17 |

Amendment and Termination of the 2018 Plan. The Board may amend, suspend, discontinue, or terminate the 2018 Plan or the Committee’s authority to grant awards thereunder without stockholder approval, except as required by law or regulation or under rules of the stock exchange on which our stock may then be listed, and except as explained above regarding repricing. The Committee can adopt amendments pertaining to matters within the scope of the Committee’s authority under its Charter, but subject to stockholder approval to the same extent as a Board amendment. Unless earlier terminated, the authority of the Committee to make grants under the 2018 Plan will terminate ten years after stockholder approval of the 2018 Plan, and the 2018 Plan will terminate when no shares remain available and we have no further obligation with respect to any outstanding award.

Federal Income Tax Implications of the 2018 Plan

We believe that, under current law, 2018 Plan awards typically would have U.S. Federal income tax consequences as follows:

Generally, the grant of an option or an SAR will create no federal income tax consequences for the participant or MariMed. A participant will not have taxable income upon exercising an option that qualifies as an ISO, except that the alternative minimum tax may apply. A participant exercising an option that is not an ISO generally must recognize ordinary income equal to the excess of the fair market value of the option shares on the date of exercise minus the aggregate exercise price paid. Upon exercising an SAR, the participant must generally recognize ordinary income equal to the cash or the fair market value of the shares received.

Upon a disposition of shares acquired by exercise of an ISO before the end of the applicable ISO holding periods, the participant must generally recognize ordinary income equal to the lesser of (i) the fair market value of the ISO shares at the date of exercise minus the exercise price or (ii) the amount realized upon the disposition of the ISO shares minus the exercise price. Upon a disposition of ISO shares that the participant has held for the applicable holding periods (two years from the grant of the ISO and one year from the exercise), the participant will recognize no ordinary income. For all options, a participant’s sale of shares acquired by exercise of the option generally will result in short-term or long-term capital gain or loss measured by the difference between the sale price and the participant’s tax “basis” in such shares. The tax “basis” normally is the exercise price plus any amount he or she recognized as ordinary income in connection with the option’s exercise (or upon sale of the option shares in the case of an ISO). A participant’s sale of shares acquired by exercise of an SAR generally will result in short-term or long-term capital gain or loss measured by the difference between the sale price and the participant’s tax “basis” in the shares, which normally is the amount he or she recognized as ordinary income in connection with the SAR’s exercise.

We normally can claim a tax deduction equal to the amount recognized as ordinary income by a participant in connection with the exercise of an option or SAR, but no tax deduction relating to a participant’s capital gains. Accordingly, we will not be entitled to any tax deduction with respect to an ISO if the participant holds the shares for the applicable ISO holding periods before selling the shares.

The above discussion applies to options and SARs that have terms causing them not to be deferral arrangements under Code Section 409A, with the shares delivered upon exercise being freely transferable and non-forfeitable (we expect that these will be the usual terms of options and SARs).

| 18 |

Awards other than options and SARs that result in a transfer to the participant of cash or shares or other property generally will have terms intended to meet applicable requirements under Section 409A, which regulates deferred compensation. If no restriction on transferability and substantial risk of forfeiture applies to shares or property distributed to a participant, the participant generally must recognize ordinary income equal to the cash or the fair market value of shares or other property actually received. Thus, for example, if an award of restricted stock units has not yet vested, or the receipt of cash or shares under a vested award has been validly deferred, the participant should not become subject to income tax until the time at which shares or cash are actually distributed, and we would become entitled to claim a tax deduction at that time.

On the other hand, if a restriction on transferability and substantial risk of forfeiture applies to shares or other property actually distributed to a participant under an award (such as, for example, a grant of restricted stock), the participant generally must recognize ordinary income equal to the fair market value of the transferred amounts at the earliest time either the transferability restriction or risk of forfeiture lapses. We can claim a tax deduction equal to the ordinary income recognized by the participant, except as discussed below. A participant may elect to be taxed at the time of grant of restricted stock or other restricted property rather than upon lapse of restrictions on transferability or the risk of forfeiture, but if the participant subsequently forfeits such shares or property he or she would not be entitled to any tax deduction, including as a capital loss, for the value of the shares or property on which he or she previously paid tax.

Any award that is deemed to be a deferral arrangement (that is, not excluded or exempted under the tax regulations) will be subject to Code Section 409A. Participant elections to defer compensation under such awards and as to the timing of distributions relating to such awards must meet requirements under Section 409A in order for income taxation to be deferred upon vesting of the award and tax penalties avoided by the participant.

Internal Revenue Code Section 162(m) limits the deductions a publicly held company can claim for compensation in excess of $1.0 million in a given year paid to the chief executive officer, the chief financial officer and certain other of the most highly compensated executive officers. Compensation to certain employees resulting from vesting of awards in connection with a change in control or termination following a change in control also may be non-deductible under Internal Revenue Code Sections 4999 and 280G.

| 19 |

The foregoing provides only a general description of the application of federal income tax laws to certain awards under the 2018 Plan. This discussion is intended for the information of stockholders considering how to vote at the Annual Meeting and not as tax guidance to participants in the 2018 Plan, as the consequences may vary with the types of awards made, the identity of the recipients and the method of payment or settlement and other circumstances. Different tax rules may apply, including in the case of variations in transactions that are permitted under the 2018 Plan (such as payment of the exercise price of an option by surrender of previously acquired shares). The summary does not address in any detail the effects of other federal taxes (including possible “golden parachute” excise taxes) or taxes imposed under state, local or foreign tax laws.

The Board considers the Amended and Restated 2018 Stock

Award and Incentive Plan to be in the best interests of the

Company and its Stockholders and therefore recommends

that you vote for approval of the plan at the Annual

Meeting.

* * * * *

Company Equity Compensation Plans

The following table sets forth information as of December 31, 2018 with respect to compensation plans (including individual compensation arrangements) under which equity securities of the Company are authorized for issuance.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans |

|||||||||

| Equity compensation plans approved by stockholders(1) | 3,400,000 | $ | 0.24 | 0 | ||||||||

| Equity compensation plans not approved by stockholders(2) | 4,445,000 | $ | 1.87 | 35,130,000 | ||||||||

| Total | 7,845,000 | 35,130,000 | ||||||||||

| (1) | Consist of grants under the 2011 Plan. | |

| (2) | Consist of grants under the 2018 Plan. A description of the 2018 Plan is included in Proposal 2, above, to this Proxy Statement and a copy of the 2018 Plan is attached to this Proxy Statement as Appendix A. |

| 20 |

Section 16(a) Beneficial Ownership Reporting Compliance

Under Section 16(a) of the Exchange Act, all executive officers, directors, and each person who is the beneficial owner of more than 10% of the Common Shares of a company that files reports pursuant to Section 12 of the Exchange Act, are required to report the ownership of such Common Shares, options, and stock appreciation rights (other than certain cash-only rights) and any changes in that ownership with the SEC. Specific due dates for these reports have been established, and we are required to report, in this Proxy, any failure to comply therewith during the fiscal year ended December 31, 2018.

We believe that all of these filing requirements were satisfied by the Company’s executive officers, directors and by the beneficial owners of more than 10% of our Common Shares except that one of our directors, Bernard Stolar, failed to file a Form 4 with respect to his sale of 43,305 Common Shares in October 2018. In making this statement, we have relied solely on copies of any reporting forms received by us, and upon any written representations received from reporting persons that no Form 5 (Annual Statement of Changes in Beneficial Ownership) was required to be filed under applicable rules of the SEC.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

In May 2014, the Company, through its subsidiary MariMed Advisors Inc., acquired Sigal Consulting LLC from its ownership group which included the current CEO and CFO of the Company, Messrs. Robert Fireman and Jon Levine, respectively (the “Sigal Ownership Group”). The purchase price for the LLC was comprised of (i) 31,954,236 Common Shares valued at approximately $5.9 million, representing 50% of the Company’s outstanding shares on the closing date, (ii) options to purchase three million Common Shares, which expires in September 2019, with exercise prices ranging from $0.15 to $0.35, and valued at approximately $570,000, and (iii) a 49% ownership interest in MariMed Advisors Inc.

In September 2016, the Company entered into a 15-year mortgage agreement with Bank of New England for the purchase of a 45,070 square foot building in Wilmington, Delaware which was developed into a cannabis seed-to-sale facility and is currently leased to the Company’s cannabis-licensed client in the state (the “2016 Mortgage”). At December 31, 2018 and 2017, the principal balance on the 2016 Mortgage was approximately $1.8 million and $1.9 million, respectively. The 2016 Mortgage accrues interest at a rate equal to 5.25% per year through September 2021, and thereafter the rate adjusts every five years to the then prime rate plus 1.5% with a floor of 5.25% per year. The 2016 Mortgage is personally guaranteed by each of the CEO and CFO of the Company.

In June 2017, the Company reacquired the 49% ownership interest of MariMed Advisors Inc. from the Sigal Ownership Group in exchange for an aggregate 75 million Common Shares.

In October 2017, the Company acquired certain assets of the Betty’s Eddies™ brand of cannabis-infused products from Icky Enterprises LLC, a company partially owned by the Company’s chief operating officer. The purchase price was $140,000 plus 1,000,000 Common Shares valued at $370,000 based on the price of the Common Shares on the issuance date.

| 21 |

In November 2017, the Company entered into a 10-year mortgage agreement with Bank of New England for the purchase of a 138,000 square foot industrial property in New Bedford, Massachusetts, within which the Company has built a 70,000 square foot cannabis cultivation and processing facility (the “2017 Mortgage”). At December 2018 and 2017, the principal balance on the 2017 Mortgage was approximately $4.9 million and $2.9 million, respectively. The 2017 Mortgage accrued interest at a rate equal to the prime rate plus 2%, with a floor of 6.25%, per year from November 2017 to May 2019, and accrues interest a rate equal to the prime rate on May 2, 2019 plus 2%, with a floor of 6.25%, per year from May 2019 to May 2024, and at a rate equal to the prime rate on May 2, 2024 plus 2%, with a floor of 6.25%, per year from May 2024 through the end of the term of the 2017 Mortgage. The 2017 Mortgage is personally guaranteed by each of the CEO and CFO of the Company.

In December 2017 and January 2018, options to purchase 400,000 Common Shares at an exercise price of $0.025 were forfeited by the CEO and by an independent Board member (200,000 shares forfeited by each individual).

In January 2018, the Company granted options to purchase an aggregate of 1.45 million Common Shares to Board members, at exercise prices ranging from $0.14 to $0.77 and expiring between December 2020 and December 2022. The fair value of these options on grant date was approximately $458,000.

At June 30, 2019, December 31, 2018 and 2017, the Company owed approximately (i) $0, $81,000 and $33,000, respectively, to the Company’s CEO and CFO, (ii) $17,000, $135,000 and $153,000, respectively, to companies partially owned by these officers, and (iii) $60,000, $60,000 and $215,000, respectively, to two stockholders of the Company. Such amounts owed are not subject to repayment schedules and are expected to be repaid during 2019.

The Board intends to adopt a policy that prohibits any transaction between the Company and a related party unless the terms of that transaction are no less favorable to us than if we had entered into the same transaction with an unrelated party and the transaction is approved by an independent committee of the Board.

| 22 |

Security Ownership of Certain Beneficial Owners

The following table, together with the accompanying footnotes, sets forth information, as of the Record Date, regarding stock ownership of all persons known by us to own beneficially more than 5% of our outstanding Common Shares, Named Executives, all directors, all director nominees, and all directors and officers as a group:

| Name & Address of Beneficial Owner(1) | Amount & Nature of Beneficial Owner | % of Class(2) | ||||||

| Robert Fireman | 23,755,218 | (3) | 10.9 | % | ||||

| Jon R. Levine | 26,706,517 | (4) | 12.2 | % | ||||

| Edward Gildea | 529,391 | (5) | * | |||||

| Bernard Stolar | 339,319 | * | ||||||

| David Allen | - | - | ||||||

| Eva Selhub, M.D. | - | - | ||||||

| All directors and executive officers as a group (five (5) persons) | 51,071,750 | (6) | 23.5 | % | ||||

| Greater Than 5% Stockholders | ||||||||

| Gerald McGraw | 17,729,932 | 8.1 | % | |||||

| James Griffin | 17,179,932 | 7.9 | % | |||||

| * | Less than one percent. | |

| (1) | The business address for each person named is c/o MariMed Inc., 10 Oceana Way, Norwood, MA 02062. | |

| (2) | Calculated pursuant to Rule 13d-3(d)(1) of the Exchange Act whereby shares not outstanding which are subject to options, warrants, rights or conversion privileges exercisable within 60 days are deemed outstanding for the purpose of calculating the number and percentage owned by a person, but not deemed outstanding for the purpose of calculating the percentage owned by each other person listed. We believe that each individual or entity named has sole investment and voting power with respect to the Common Shares indicated as beneficially owned by them (subject to community property laws where applicable) and except where otherwise noted. All percentages are determined based on 218,045,067 Common Shares outstanding as of the Record Date. | |

| (3) | Includes 500,000 currently exercisable stock options. | |

| (4) | Includes 450,000 currently exercisable stock options. | |